Resources to Build Resiliency for European Startups

"Every (wo)man is a piece of the continent, a part of the main" — John Donne

Six weeks of social distancing and an Easter long weekend has provided ample time for reading and reflection.

As we transition from fear to learning and growth, I wanted to share some insights, articles and resources that I have found valuable.

This post will cover the following topics:

Role of Government in Saving Startups

Recycling of Tech Talent

Fundraising during Uncertainty

What is your Ikigai?

Role of Government in Saving Startups

I have friends who have moved to a new company, country, and continent several months ago only to be let go in recent weeks as their startup restructures its organization in order to prepare for the worst yet to come.

While some believe an economic downturn has been overdue for a couple years now — due to excess quantitative easing (read these articles by World Economic Forum, Financial Times, and South China Morning Post) — the role and participation of government when it comes to supporting a vibrant technology ecosystem has been quite polarizing across UK and Europe in recent weeks.

With the lobbying of United Tech of Europe, it is clear that some believe the appropriate course of action is to follow in the footsteps of France which is regarded as generous when it comes to ‘bailing out’ its startups. Others like UK venture veteran Robin Klein argues the contrary — it is the investors, not the government’s job.

In considering different viewpoints, we must keep in mind that there is currently $35BN of capital available in European venture capital — this figure is 1.7x more than 5 years ago. In the past 5 years, $9BN of taxpayers’ money has been allocated by government agencies to professional, specialist investors who are existing shareholders (insiders) of venture-backed startups. In addition, there are many essential sectors which form the backbone of Europe’s economy — these include industry and agriculture which contribute 27% or $4.6TN to overall GDP.

On the other hand, a key attraction of the venture and startup ecosystem is the economic growth it stimulates — top quartile European investors generated 20–25% IRR, which is 10–13x higher than Europe’s annual GDP growth of 2% over the past decade (based on 2010 vintage reported by EIF and World Bank data). This excludes the indirect impact venture has on transforming ‘old world’ industries and making them more efficient. The opportunity cost though is startups take at least 5+ years to be profitable (while creating employment opportunities in the interim) and 70% of taxpayers’ money is loss-making, given the high risk, high reward nature and Power Law distribution of venture capital (reported by EIF on page 6 of 2017 report ).

Recycling of Tech Talent

Businesses and individuals have been adapting to our ‘new normal’, including remote work and home education over the past month.

One of the key ways to sustain a vibrant ecosystem is to help talent transition into strong and resilient businesses that continue to grow profitably and create long term value.

Below are some resources for those seeking new opportunities in tech:

Candor — global database providing pulse on hiring freeze and layoffs

Layoffs.fyi — US centric including global companies born in Europe

Parachute— US centric with some opportunities in Canada, India and other

Stillhiring — global database of all sectors including tech

Sifted — list of UK and European tech companies hiring

Belgium — Belgian startups that are hiring and talent that are looking for new role

Netherlands — Dutch startups and venture firms that are hiring

Nordics — Danish, Finnish, Swedish and Norwegian startups that are hiring and talent that are looking for new role

COVID-19: Startup Resources & Insights — US centric guide with some European resources included in the ‘Layoff and Talent Resources’ section

Outreach — US B2B software opportunities

Otta—London (UK) startup jobs

Please share other crowdsourced lists you have come across.

Fundraising during Uncertainty

As mentioned in a recent post, 60%+ of European VCs are still actively investing (based on the self-declaration of 347 funds of 452 in total and Covid-19 Euro Investors Pulse Survey).

In particular, those that are actively deploying capital into new startups — and not just tracking for the sake of future investment optionality — mostly likely will have the following behaviour pattern:

Active demonstrated by their funding activity in February, March, or April. (Speak with the founders of those recently funded businesses!)

Fund was raised in 2018, 2019, or 2020 (i.e. “initial close” is less than 2 years ago) and less than 50% of capital dedicated to new investment opportunities has been deployed

Prepared for a recession in Q4’19 or Q1’20 and have already received money from their LPs (a.k.a. “drawn down capital” or “called capital”)

Committed to the startup’s founding team and its long-term vision by offering reasonable terms, including at least 18 months of funding

As the valuation for public B2B software companies have reduced by 30% and the Enterprise Value to Annualized Revenue has declined to 10–12x (see BVP Nasdaq Emerging Cloud Index; multiple range on a median and mean basis), I would expect even the fastest growing and highly ‘auctioned’ startups to be valued similarly at best.

Given that ownership stakes for most Series A investors range 15–25%, the amount of capital a startup can fundraise will likely adjust accordingly in today’s market.

I found these articles most relevant on this topic: TechCrunch, Tom Tunguz, Kauffman Fellows.

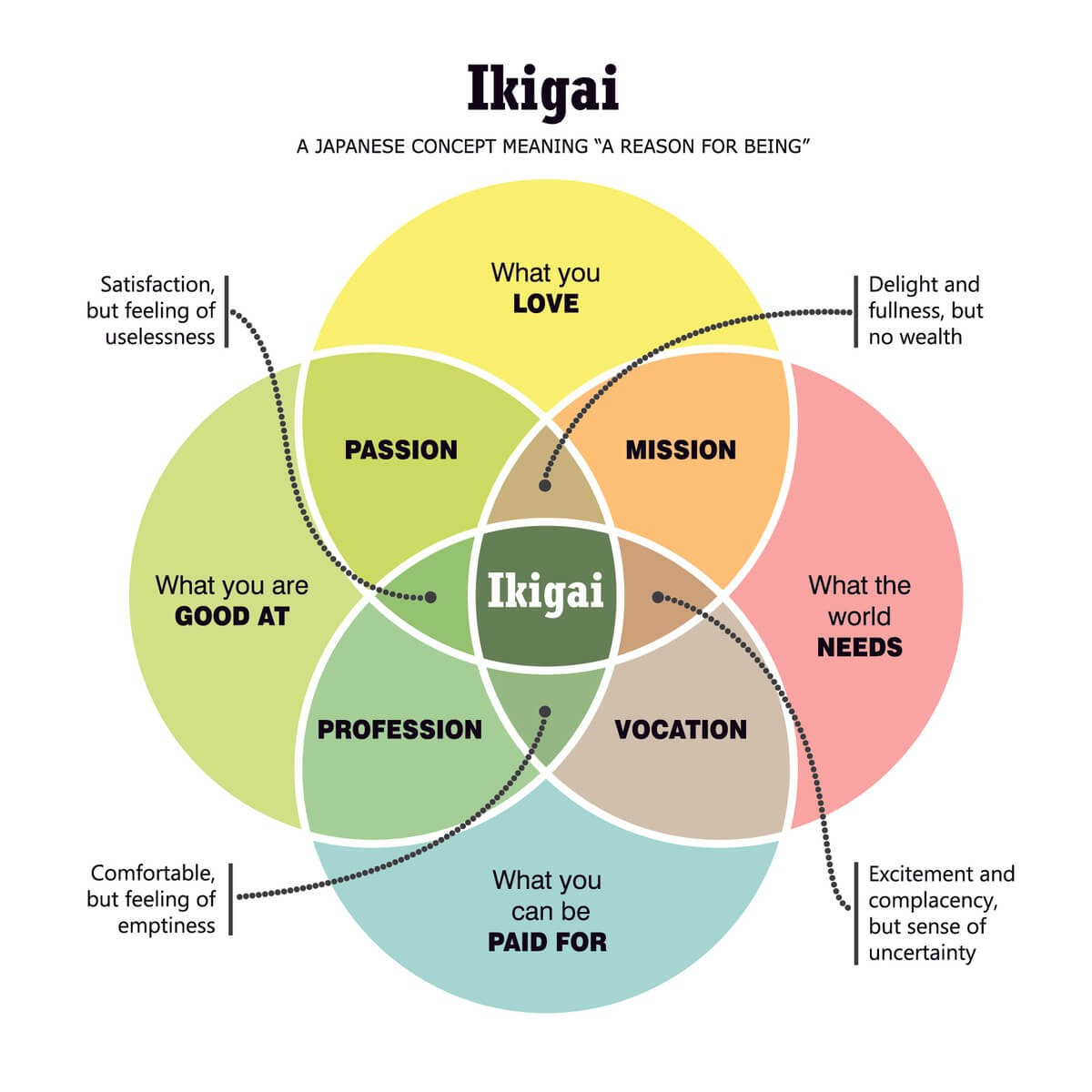

What is your Ikigai?

We increasingly live in a world where specialists are valued more highly than generalists.

In reflecting on professional and personal pursuits, I like to use an ancient Japanese concept called Ikigai. There are many different takes on this (see here, here, and here for more), and I believe this framework to be beneficial for all aspects of life.

An example of this well-executed is the One World: Together At Home concert initiated by Lady Gaga in collaboration with WHO to support frontline healthcare workers.

It airs this Saturday, April 18th at 8pm ET and on BBC One the next day (Sunday, April 19th) at 7:15pm BST.

I will be watching it and hope you will join too!

Great concepts, fantastic approaches, take action right now!!!