How to Play Offensive in a Recession: Flight to Quality Planning

“Planning is bringing the future to the present so that you can do something about it now” - Alan Lakein

It is clear the (overindulgent) ‘growth-at-all cost’ mindset of recent years has come to an end. Very unfortunate that it has taken a horrific war to trigger an (overdue) economic and financial markets correction, including a return to the fundamentals of scaling and growing a sustainable business.

In this post, I will outline:

Financial markets overview and European VC sentiment

Scale-up recession checklist for Founders and Operators

Financial markets overview and European VC sentiment

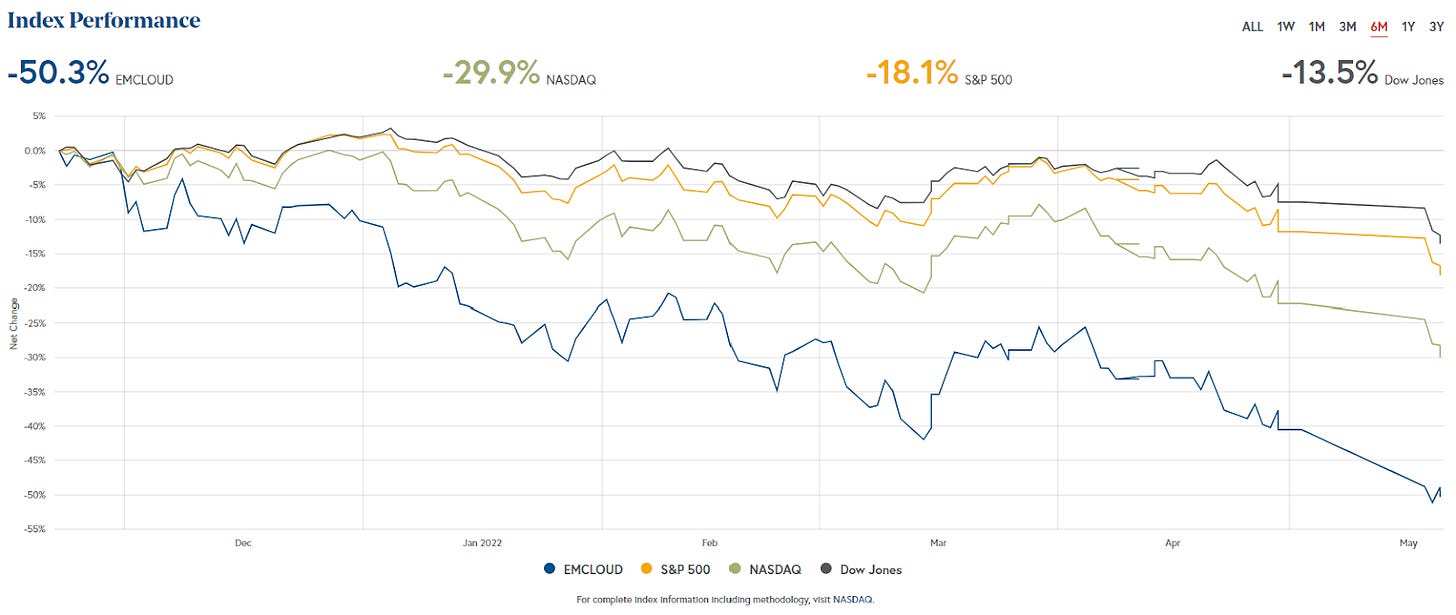

Recent mixed public company earnings combined with a (likely) economic recession have resulted in significant sell-off in tech and software companies, with valuations declining by 30-50% compared to the start of this year, most notably over the last two months.

While current financial health remains similar, public Cloud companies are now trading on current revenue multiples of 9.7x and 7.5x for top and median quartile businesses, respectively, with investors placing a premium on companies that have a balanced mix of revenue growth, margins, and capital efficiency. (This is in contrast to emphasis on forward 12-month revenue which we experienced in recent years.)

The VIX index, which measures market volatility and stock market sentiment, continues to trend upwards - implying that the IPO market will remain closed for the foreseeable future. (General rule of thumb for a healthy IPO market is for the VIX to be trading below 15-20.)

Last year’s media headlines which celebrated Tiger’s very aggressive investment strategy are now highlighting the staggering consequences on its public hedge fund and what it could mean for their early venture bets in the future.

Incubator YCombinator advised startup founders to plan for the worst including releasing a sarcastically realistic YouTube video full of practical tips.

This past month, I spoke with London and US funds who invest 10-100 million in European businesses to gain their perspective on the European tech startups and venture ecosystem. It can be summed up as follow:

Evaluating the impact of a recession on portfolio companies - there has been little change in the growth of startups and scale-ups so far; what has changed is valuation multiples and risk appetite. Top performing Series A/B businesses are still receiving term sheets at similar terms as last year; while the rest are not getting any interest at all (not even with founder unfriendly terms). Consumer and FinTech companies in particular have been most impacted.

Advising startups to control costs and preserve cash for a longer runway - fundraising for below top quartile businesses will be a lot more challenging in an economic downturn. Startups and scale-ups should focus on controlling cash burn and margins, in addition to having sufficient cash runway to survive beyond 18 months.

So what does this practically mean in terms of operational priorities and deliverables for a scale-up founder and operator?

Scale-up recession checklist for Founders and Operators

1. Control burn and extend cash runway

If the financial markets are undergoing what we experienced in 2007-2008, then it is sensible to reduce burn such that Net New ARR to Net Cash Burn over the same period is ideally around 1 (and definitely less than 2) and ensure the business has the longest cash runway available. Assume the next fundraise will be highly challenging or not possible.

2. Monitor future cash with a rolling forecast

The beauty of SaaS is cash and negative working capital which allows for high experimentation to be paid upfront by investors and customers; however, the cost can be painful (or deadly) if not monitored and controlled closely.

To do #1 well while continuing to grow requires an accurate rolling weekly cash forecast. In a spreadsheet, list out every single cash line item (€/£/$) flowing in and out of the business, on a weekly basis, for the next 4 months and longer.

A business should never operate on less than 6 months of cash runway, particularly in this market. Make sure there is a reliable source of contingency funding in place that excludes new investors.

3. Create optionality with 3-scenario integrated planning

This is a critical one that many VC-backed startups and scale-ups businesses fall short on (or not do at all), especially in recent years.

A business which has not yet achieved economies of scale (or sufficient operating leverage)1 - unprofitable, burning cash, and growing less than 40% per year2 - requires sophisticated planning based on reliable structured data and thoroughly well-researched business strategy, ideally led by operators experienced in scaling Series A to C.

This requires integrating a top-down approach which accounts for the interest of all key stakeholders (i.e. market, customers, competition, investors, and lenders) as well as an equally important bottoms-up capacity plan (i.e. time to hire and ramp, individual and team quotas/attainment/coverage ratios, talent expertise and seniority compensation, mix of acquisition channels) to derive an accurate monthly revenue forecast and sensible quarterly business plan.

I recommend creating 3 different operating scenarios:

Growth-at-all-costs expected of top quartile VC-backed SaaS businesses, including Net New ARR to Net Cash Burn below 2 and cash runway of 18 months,

Sustainable growth where:

(i) Net New ARR added per month/quarter exceeds (or at a minimum, is the same as) the prior period

(ii) Net New ARR to Net Cash Burn per month/quarter is between 1 and 1.5

(iii) Gross Retention and Net Retention is at or ideally exceeds 90% and 120%, respectively

(iv) Cash runway is 18-24 months

Survival or path to exit where business becomes (i) profitable without further external funding while continuing to grow to scale3, or (ii) break-even before a M&A sale process (assume 12+ months)

For more metrics and growth benchmarks, refer to a16z’s recent article and Brighteye Ventures’ post from yesterday.

4. Be proactive, agile, and opportunistic

With solid control and visibility on cash, unit economics, and several plans on how to navigate forward, a business can take advantage of the opportunities that arise in a downturn. These could include:

Raise more funding now from existing investors, lenders, and banks (before things get even worse)

Hire from or acquire your competitors. Klarna, Gorillas, Kry, amongst other VC-backed businesses across Europe and the US recently announced lay-offs. (People account for 60-80% of the cost for most businesses, so the fastest way to preserve cash is to let go of people.)

Improving service and increasing value for existing customers (not price increase!)

Build partnerships with established and trusted brands

While the above may seem like common sense (fundamentals have not changed), a business can only confidently take advantage of a crisis (#4) by having a strong foundation in place (by doing #1, #2, and #3).

Surviving and thriving in a recession is the ultimate test of product-market fit and go-to-market success.

So rise to the occasion, solidify your foundation, take calculated and real risk, and be rewarded by knowing your numbers and customers 10x better than anyone else.

Additional reading

On macro outlook and preparing for a recession:

Adapting to Endure (Sequoia)

Recession deep dive (All-In podcast + YouTube channel by Chamath, Jason, Sacks & Friedberg)

Economic Downturn (YC)

Building a startup during a downturn (Bessemer)

The upside of a downturn (Lightspeed)

On fundraising and venture debt:

Fundraising in a Downturn (Brighteye Ventures)

The Inherent Friction between Founders, VCs, and Venture Debt

For most VC-backed software businesses, scale and operating leverage is achieved around 100 to 250 FTEs (or 10–30MM ARR), as a business is then typically quite predictable and profitable while continuing to grow. This is also when strategic buyers show real interest. ‘Operating leverage’ described in everyday language can be found in What I Learned as an European Software VC and How to Prepare Your B2B Software Startup for a Bumpy Ride.

The average growth rate of a public Cloud business is currently 38%. The most common path to exit for VC-backed businesses is a sale to or purchase by a strategic buyer. However, most corporates favour acquiring businesses for revenue (typically starting at 10-20MM ARR) and strategic value (e.g. product and IP, geography, customer segment) over only raw talent. (Since they prefer to recruit directly rather than incur business time, risk, and cost attached with M&A).

See note #1. As a SaaS business, it is very tricky to be profitable below 5-10MM ARR, unless the business bootstrapped relying heavily on inbound demand.

As always, great insights and very practical go-do advices

Great viewpoints and help us comprehensive understanding to guide us! Thanks, Joyce!